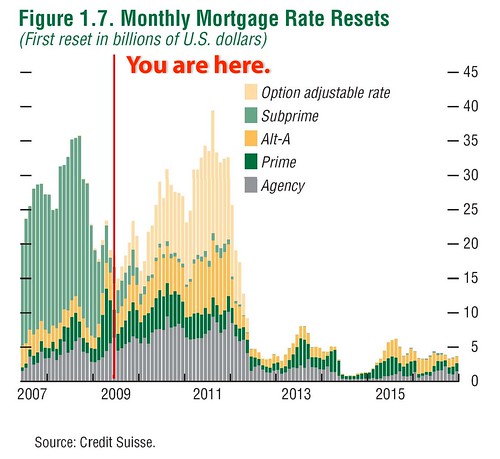

A couple of years ago, I posted a graphic of the mortgage resets from Credit Suisse First Boston. Let’s see where we are now.

Congratulations to all. We’ve made it through the subprime crisis and only lost GM, every investment bank, nearly wiped out the FDIC Deposit Insurance Fund, put 1 out of 8 homeowners late or in foreclosure on their mortgages, and sent the economy into a tailspin. Otherwise, we made it through the subprime crisis.

We’re ready to start growing again, right?

Except… except the pool of alt-A and option ARM mortgages (all of which is defaulting at the same or higher rates of default than subprime 2 years ago) is still ahead, and it’s 50% bigger than the subprime mortgage market ever was.

If you’re thinking the worst of the storm has passed, it’s more like the eye of the hurricane. The second, stronger wall of the storm is arriving shortly. If you’re thinking that now is the time to spend a little more freely, to open up your wallet, think again and batten down the hatches. If anything, now is the time to increase your financial conservatism, to tighten spending if you can. Only once the storm has fully passed – in a couple of years – will it be time to go outside and start planting anew.

For more detailed charts, check out this post on Mish’s blog.

Did you enjoy this blog post? If so, please subscribe right now!

Get this and other great articles from the source at www.ChristopherSPenn.com

Leave a Reply