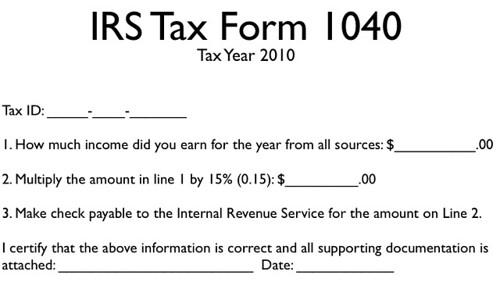

Someone with an economics background tell me why we can’t do this with the IRS tax code:

Flax Tax Return

Comments

19 responses to “Flax Tax Return”

-

Would this take into account income tax withholding or not?

-

Would this take into account income tax withholding or not?

-

There would be no withholding unless you wanted your employer to continue to do so.

-

There would be no withholding unless you wanted your employer to continue to do so.

-

short answer – this would be regressive, i.e., would disproportionately tax the poorest and most vulnerable among us

there are states (including mine, illinois) that have flat tax rates – some even have no “zero bracket” – this is generally a bad thing for the poor and for working families because they pay disproportionately to the services they receive from government

-

How is applying the same tax rate to everyone regressive?

If you earn 10,000, you pay1,500. 15%.

If you earn 10,000,000, you pay1,500,000. 15%.Both people pay the same proportional share of taxes of their income.

How is this disproportionate?

-

I’m no economics major, but there’s a big problem with a “one tax fits all” approach.

There are certain expenses which are unavoidable.

If I make 12,168 (federal minimum wage of 5.85 * 40 hours * 52 weeks), 15% is1,825. Aside from the fact that a flat tax would probably be more like 35% or more, let’s see where that’s going to come out of.

After gas for my car (30 * 52 = 1,560), meager amounts of cheap food (10 * 7 * 52 = 3,640), and maybe a new workshirt every once in a while or a car repair (1,000), I’ve got6868 left. Oh, right I need somewhere to sleep, so I split an apartment with my buddy, each chipping in 400 a month. I’ve got 2,068 left. Lets say50 a month for my half of the gas/electric, I’m down to 1,468.

I’ve worked a full time, 40 hour week at a crap job, paid only for the essentials, and I can’t even afford my taxes. They’re more than 100% of my ‘discretionary’ income.

Meanwhile, Joe 50K works in NYC. Things are a little more expensive there, but lets look at the costs he can’t avoid.50,000 * .15 = 7500. Seems like Joe’s got a much bigger tax burden than our minimum wage friend above, right?

Well, unavoidable costs are similar, but cost of living is higher in NYC, so let’s see whats ‘essential’ for Joe.

1200 – monthly subway card + a few trips further out by bus, etc)7280 – (20 * 7 * 52) food is more expensive in NYC1000 Clothes, computer repair, other incidentals

14400 (1,200 * 12) rent for a studio in brooklyn

3000 (250 * 12) cable, electric, broadband, gas + elecAfter “unavoidable” costs (and some of those costs for Joe 50k are much more avoidable), He’s still got 23,120. His .15% taxes of7,500 are less than a third of his discretionary income.

That’s the long and short of it. Taxes as they are today take some small steps to try to account for unavoidable expenses. Deductions, brackets, and other complexities do their best to equalize the percentage of discretionary funds that we actually are taxed on, rather than simply basing it on how much you make.

I have no problem pay a bigger percentage of my wage as I make more. To be frank, it hurts a lot less now than it did when that lower percentage was a much bigger chunk of my discretionary funds.

Even with our complex tax system, it’s still far from equalized, and don’t forget true flat taxes we already have, such as taxes on purchases. That 8.25% tax hurts people on the low end a lot more than it hurts the middle to upper classes.

-

exactly

three more points

1) the value of services received from government actually increases with one’s wealth – i know that we’ve been trained to think otherwise, so that seems a bit counterintuitive – “poor people get all of the government benefits,” etc. – but true nonetheless

2) do this calculation

(per capita gross earnings) x (current u.s. population) x15%

this would bring in no where near enough money to fund the things that some consider to be important (such as education, student financial aid, etc.)

i haven’t done this calc myself, but sources that i consider to be credible have

3) here is the most telling fact: check into who actually supports a flat income tax for this country – it’s people like dick armey – this alone should be enough to demonstrate that it favors the wealthy and super-wealthy over the best interests of the nation

-

exactly

three more points

1) the value of services received from government actually increases with one’s wealth – i know that we’ve been trained to think otherwise, so that seems a bit counterintuitive – “poor people get all of the government benefits,” etc. – but true nonetheless

2) do this calculation

(per capita gross earnings) x (current u.s. population) x15%

this would bring in no where near enough money to fund the things that some consider to be important (such as education, student financial aid, etc.)

i haven’t done this calc myself, but sources that i consider to be credible have

3) here is the most telling fact: check into who actually supports a flat income tax for this country – it’s people like dick armey – this alone should be enough to demonstrate that it favors the wealthy and super-wealthy over the best interests of the nation

-

short answer – this would be regressive, i.e., would disproportionately tax the poorest and most vulnerable among us

there are states (including mine, illinois) that have flat tax rates – some even have no “zero bracket” – this is generally a bad thing for the poor and for working families because they pay disproportionately to the services they receive from government

-

How is applying the same tax rate to everyone regressive?

If you earn 10,000, you pay1,500. 15%.

If you earn 10,000,000, you pay1,500,000. 15%.Both people pay the same proportional share of taxes of their income.

How is this disproportionate?

-

I’m no economics major, but there’s a big problem with a “one tax fits all” approach.

There are certain expenses which are unavoidable.

If I make 12,168 (federal minimum wage of 5.85 * 40 hours * 52 weeks), 15% is1,825. Aside from the fact that a flat tax would probably be more like 35% or more, let’s see where that’s going to come out of.

After gas for my car (30 * 52 = 1,560), meager amounts of cheap food (10 * 7 * 52 = 3,640), and maybe a new workshirt every once in a while or a car repair (1,000), I’ve got6868 left. Oh, right I need somewhere to sleep, so I split an apartment with my buddy, each chipping in 400 a month. I’ve got 2,068 left. Lets say50 a month for my half of the gas/electric, I’m down to 1,468.

I’ve worked a full time, 40 hour week at a crap job, paid only for the essentials, and I can’t even afford my taxes. They’re more than 100% of my ‘discretionary’ income.

Meanwhile, Joe 50K works in NYC. Things are a little more expensive there, but lets look at the costs he can’t avoid.50,000 * .15 = 7500. Seems like Joe’s got a much bigger tax burden than our minimum wage friend above, right?

Well, unavoidable costs are similar, but cost of living is higher in NYC, so let’s see whats ‘essential’ for Joe.

1200 – monthly subway card + a few trips further out by bus, etc)7280 – (20 * 7 * 52) food is more expensive in NYC1000 Clothes, computer repair, other incidentals

14400 (1,200 * 12) rent for a studio in brooklyn

3000 (250 * 12) cable, electric, broadband, gas + elecAfter “unavoidable” costs (and some of those costs for Joe 50k are much more avoidable), He’s still got 23,120. His .15% taxes of7,500 are less than a third of his discretionary income.

That’s the long and short of it. Taxes as they are today take some small steps to try to account for unavoidable expenses. Deductions, brackets, and other complexities do their best to equalize the percentage of discretionary funds that we actually are taxed on, rather than simply basing it on how much you make.

I have no problem pay a bigger percentage of my wage as I make more. To be frank, it hurts a lot less now than it did when that lower percentage was a much bigger chunk of my discretionary funds.

Even with our complex tax system, it’s still far from equalized, and don’t forget true flat taxes we already have, such as taxes on purchases. That 8.25% tax hurts people on the low end a lot more than it hurts the middle to upper classes.

-

i ran these calculations myself

32,476.60 x 301,139,947 x .15 =

about1.467 trillion

estimated receipts from individual federal taxes for 2007 = $1.984 trillion

so at a 15% flat tax rate, we’d need 517 billion dollars this year in spending cuts, further deficits or additional revenue

-

i ran these calculations myself

32,476.60 x 301,139,947 x .15 =

about1.467 trillion

estimated receipts from individual federal taxes for 2007 = $1.984 trillion

so at a 15% flat tax rate, we’d need 517 billion dollars this year in spending cuts, further deficits or additional revenue

-

Ah! Finally a chance to flash my Economist badge! *digging through bag to find dust covered relic*…

The answer is that there is an entire industry of legal and accounting professionals who lobby that would be wiped out by that form.

-

Ah! Finally a chance to flash my Economist badge! *digging through bag to find dust covered relic*…

The answer is that there is an entire industry of legal and accounting professionals who lobby that would be wiped out by that form.

-

Well, John Wall beat me to it…

There’s nothing wrong with that form except that it doesn’t lend itself to propagating the jobs of hundreds of tax attorneys, lobbyists, and politicians.(I love it when people say that a flat tax % is “disproportionate” – makes me want to pull out a dictionary.)

-

Well, John Wall beat me to it…

There’s nothing wrong with that form except that it doesn’t lend itself to propagating the jobs of hundreds of tax attorneys, lobbyists, and politicians.(I love it when people say that a flat tax % is “disproportionate” – makes me want to pull out a dictionary.)

-

I have to say, you did a really nice job on explaining something that can be really tricky at times. There are times that I struggle with wrapping my head around topics like the

this, thank you for summing it up well.

God bless youThanks!

Leave a Reply