Social media is nothing new. It’s been around for almost two decades. However, new practitioners are constantly entering field, and with every new marketing professional comes the risk of repeating the mistakes of the past. The old aphorism, “those who do not learn history are doomed to repeat it” is just as true in marketing as it is in life.

In this series, we’ll examine modern enterprise social media strategy, what marketers need to know to make social media work for the midsize or enterprise organization.

Part 4: Choose

Once we’ve ascertained our goals and the content we intend to create, we must choose where we will place our content online. Which channels should we use, and how much should we invest in them, both time and money?

The pay answer we use for small to midsize businesses is to simply test and see which channels resonate most. However, for the enterprise, which typically has greater access to various measurement and analytics tools, we are able to begin with more insights.

We triangulate on channel choice by examining six metrics from various analytics tools:

- Our social traffic to owned properties

- Our content’s activity on social media

- Our key competitor’s social traffic to owned properties

- Our key competitor’s content’s activity on social media

- An industry publication’s social traffic to owned properties

- An industry publication’s content’s activity on social media

Current Social Traffic

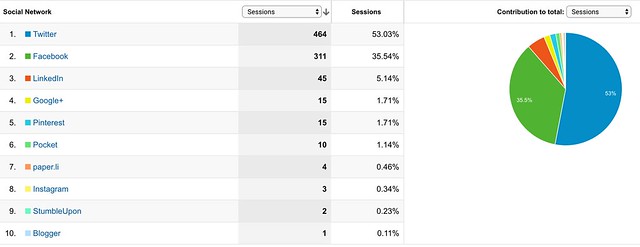

Using our web analytics, we should ascertain how much current social media traffic we get, and from what sources:

Make a note of this – which social networks are already sending us traffic? For my website, it’s Twitter.

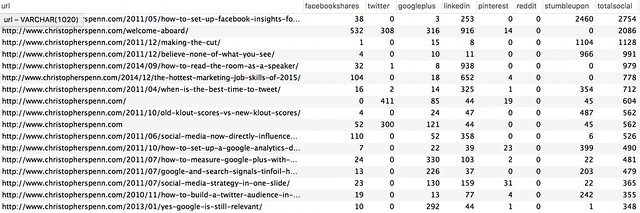

Current Owned Content Engagement

Using content marketing analytics tools like SHIFT Communications’ SCALE scanner, we should ascertain which networks our content is already shared on:

Based on what gets shared the most, and on what network, we will make note of where we are already succeeding. What content already creates engagement? Our content is doing well on LinkedIn.

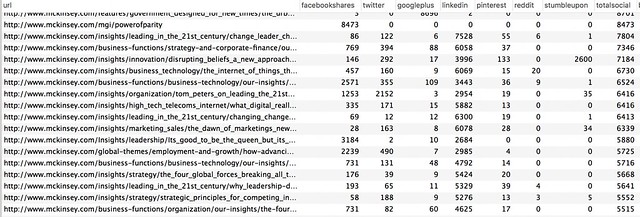

Competitor Social Traffic

With an identified key competitor, we will run the same analyses. Where does our key competitor get their social media traffic? Using enterprise SEO and analytics tools like SEMRush, we can discover this:

We see a chosen competitor, McKinsey, attracting heavy traffic to their website from LinkedIn.

Competitor Content Engagement

With an identified key competitor, we will run the same analyses. What content does well for our competitor, and on which networks?

We see McKinsey strong on LinkedIn, with Facebook a near second.

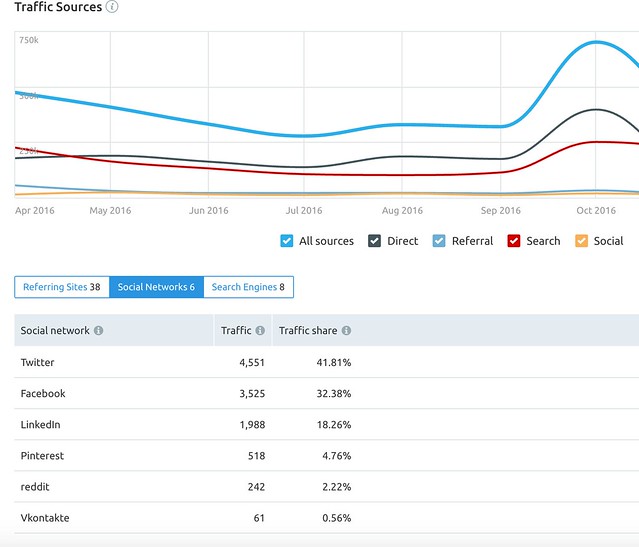

Industry Publication Social Traffic

With an identified industry publication, we will run the same analyses. Where does our industry publication get their social media traffic? Using enterprise SEO and analytics tools like SEMRush, we can discover this:

We’ve chosen MarketingProfs as our reputable industry publication. Where does their social traffic come from? Interestingly, it’s Twitter and Facebook.

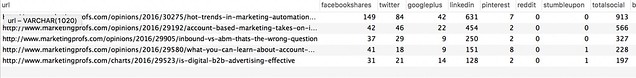

Industry Publication Content Engagement

With an identified industry publication, we will run the same analyses. What content does well for our industry publication, and on which networks?

Interestingly, even though MarketingProfs obtains traffic from Facebook and Twitter, their content is shared most on LinkedIn.

Choose Wisely!

Based on the results above, we see two out of three organizations are potentially misaligned. My website, and our industry publication, have very different sources of traffic compared to where their content is shared the most. This indicates both a danger and an opportunity. For our key competitor, their content and sharing are in sync with each other.

We now know we should probably pivot to focus more heavily on extracting traffic from LinkedIn, while continuing to bolster traffic from other networks.

One key consideration we cannot see from the analytics tools above is whether activity, especially engagement, is bolstered by paid media, by digital advertising. I recommend that in the beginning, plan to divide your social media dollar in quarters:

- 25% towards the creation of content – including FTEs to create all forms of content

- 25% towards the distribution of content – including FTEs to post and manage it

- 25% towards the activation of content – including influencers, advertising, and management

- 25% towards the measurement of content – including FTEs to perform data analysis and provide insights

Once started, adjust budgets as needed based on the areas needing the most help.

In the next post in this series, we’ll tackle influencers and audiences.

The 8C Enterprise Social Media Strategy Framework

- Enterprise Social Media Strategy, Part 1 of 9: Introduction

- Enterprise Social Media Strategy, Part 2 of 9: Clarify

- Enterprise Social Media Strategy, Part 3 of 9: Create

- Enterprise Social Media Strategy, Part 4 of 9: Choose

- Enterprise Social Media Strategy, Part 5 of 9: Connect

- Enterprise Social Media Strategy, Part 6 of 9: Coordinate

- Enterprise Social Media Strategy, Part 7 of 9: Collaborate

- Enterprise Social Media Strategy, Part 8 of 9: Communicate

- Enterprise Social Media Strategy, Part 9 of 9: Conclude

You might also enjoy:

- Mind Readings: You Need Passwords for Life in the Age of Generative AI Fraud

- Mind Readings: What Makes A Good Conference/Event?

- You Ask, I Answer: Legality of Works in Custom GPTs?

- You Ask, I Answer: Retrieval Augmented Generation for Tax Law?

- You Ask, I Answer: Reliability of LLMs vs Other Software?

Want to read more like this from Christopher Penn? Get updates here:

Take my Generative AI for Marketers course! |

Leave a Reply